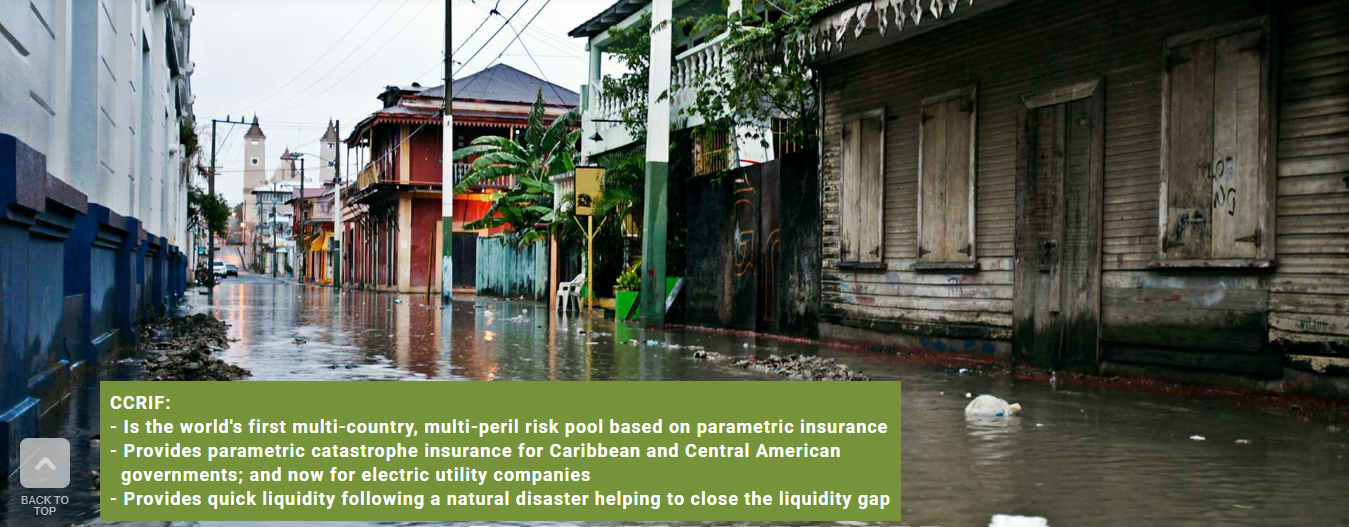

CCRIF SPC is a segregated portfolio company, owned, operated and registered in the Caribbean. It limits the financial impact of catastrophic hurricanes, earthquakes and excess rainfall events to Caribbean and – since 2015 – Central American governments by quickly providing short-term liquidity when a parametric insurance policy is triggered. It is the world’s first regional fund utilizing parametric insurance, giving member governments the unique opportunity to purchase earthquake, hurricane and excess rainfall catastrophe coverage with lowest-possible pricing.

In 2007, the Caribbean Catastrophe Risk Insurance Facility was formed as the first multi-country risk pool in the world, and was the first insurance instrument to successfully develop parametric policies backed by both traditional and capital markets. It was designed as a regional catastrophe fund for Caribbean governments to limit the financial impact of devastating hurricanes and earthquakes by quickly providing financial liquidity when a policy is triggered.

CCRIF SPC is registered in the Cayman Islands and operates as a virtual organisation, supported by a network of service providers covering the areas of risk management, risk modelling, captive management, reinsurance, reinsurance brokerage, asset management, technical assistance, corporate communications and information technology.

CCRIF offers earthquake, tropical cyclone and excess rainfall policies to Caribbean and Central American governments. In July 2019, the Facility, in collaboration with the World Bank and the US State Department, introduced coverage for the fisheries sector for two member countries – Saint Lucia and Grenada. In October 2020, CCRIF introduced coverage for electric utilities.

CCRIF helps to mitigate the short-term cash flow problems small developing economies suffer after major natural disasters. CCRIF’s parametric insurance mechanism allows it to provide rapid payouts to help members finance their initial disaster response and maintain basic government functions after a catastrophic event.

‘Since the inception of CCRIF in 2007, the Facility has made 54 payouts to 16 member governments on their tropical cyclone, earthquake and excess rainfall policies totalling approximately US$244.8 million. Also, CCRIF has made 23 payments totalling approximately US$2.6 million under member governments’ Aggregated Deductible Cover (ADC).

In 2014, a second MDTF was established by the World Bank to support the development of CCRIF SPC’s new products for current and to facilitate the entry for Central American countries and additional Caribbean countries. The MDTF currently channels funds from various donors, including: Canada, through Global Affairs Canada; the United States, through the Department of the Treasury; the European Union, through the European Commission; and Germany, through the Federal Ministry for Economic Cooperation and Development and KfW.

Additional financing has been provided by the Caribbean Development Bank, with resources provided by Mexico; the Government of Ireland; and the European Union through its Regional Resilience Building Facility managed by the Global Facility for Disaster Reduction and Recovery (GFDRR) and The World Bank.

In 2014, the facility was restructured into a segregated portfolio company (SPC) to facilitate expansion into new products and geographic areas and is now named CCRIF SPC. The new structure, in which products are offered through a number of segregated portfolios, allows for total segregation of risk. In April 2015, CCRIF signed an MOU with COSEFIN – the Council of Ministers of Finance of Central America, Panama and the Dominican Republic – to enable Central American countries to formally join the Facility.

The ADC is a new policy feature for tropical cyclone and earthquake policies introduced in the 2017/2018 policy year. The ADC was designed to be akin to a dedicated reserve fund providing a minimum payment for events that are objectively not sufficient to trigger a CCRIF policy, because the modelled loss is below the attachment point.

CCRIF was developed under the technical leadership of the World Bank and with a grant from the Government of Japan. It was capitalized through contributions to a Multi-Donor Trust Fund (MDTF) by the Government of Canada, the European Union, the World Bank, the governments of the United Kingdom and France, the Caribbean Development Bank and the governments of Ireland and Bermuda, as well as through membership fees paid by participating governments.